Current Deposit

Internet Explorer 11 is outdated. For improved security and optimized performance we highly recommend upgrading your browser. ChromeFirefoxEdge

|

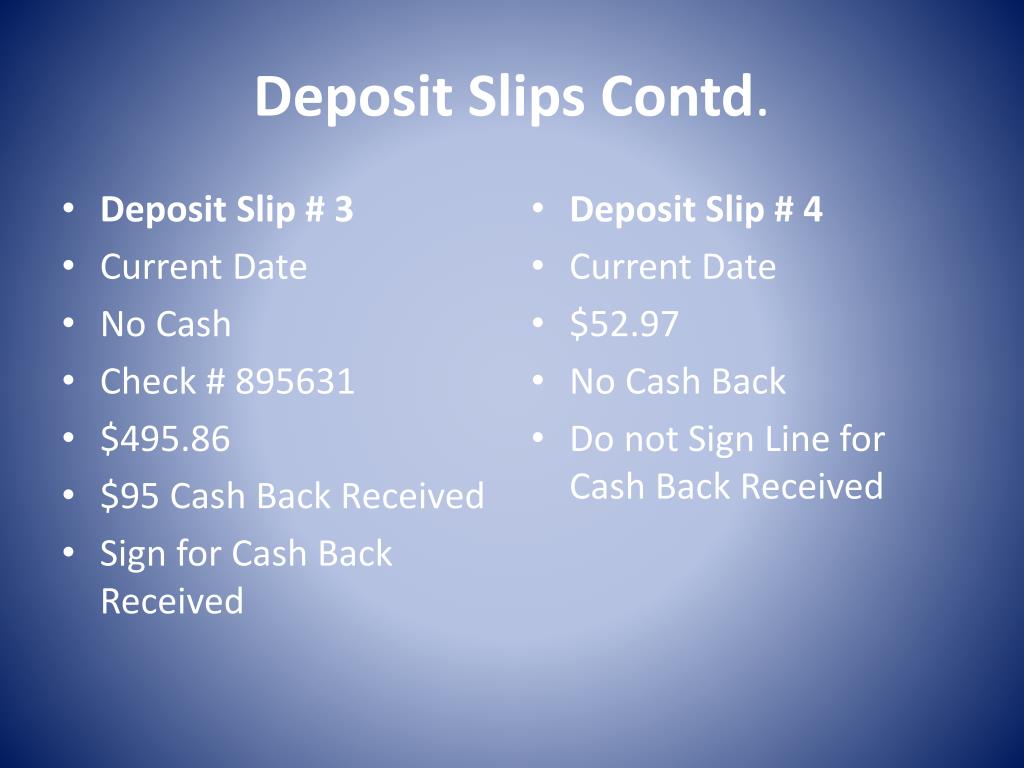

Certificates of Deposit (CD) - Regular & IRA Minimum amount to open a CD is $1,000 unless noted otherwise. See our Disclosures and Personal Service Fees. Click or Tap Here to Open Your Account. Ultra-Low Mileage Lease Example for Current Qualified Competitive Lessees. $139 per month for 24 months $0 Security Deposit $3,090 Down Payment $139 First Payment. Yes, there’s a small fee of $3.50 per deposit, which is lower than what other banks charge. Please note, your receipt may not reflect the deposit fee, but the fee will be deducted from your deposit and you’ll see the details in your transaction history. Are there any limits? You can deposit up to $500 per transaction and up to $1000 per day.

*No Penalty* feature available on 3 month CD only. **Rates may change after the account is opened. If the 6 month or 11 month CD interest rate goes up, you have the option of upgrading to the higher rate one time for the remainder of your term. ***Rates may change after the account is opened. If the 18 month or 23 month CD interest rate goes up, you have the option of upgrading to the higher rate one time for the remainder of your term.

Daily access to your money by check. You may have up to 6 debits per statement cycle. Rates may change and fees may reduce earnings. $1,000 minimum required to open a Premier Account. Interest is compounded and credited every month. Annual Percentage Yield (APY) effective 03/03/2021. |

Current Deposit Rates

Find the best CD rates by comparing national and local rates. A Certificate of Deposit is a type of savings account that has a set interest rate and withdrawal date. Typically, CD interest rates. Certificates of Deposit A Certificate of Deposit is similar to a savings account in that they are insured and thus virtually risk-free (CDs are insured by the FDIC for banks). They are different from savings accounts in that the CD has a specific, fixed term (often three months, six months or one to four years), and, usually, a fixed interest rate.